Latest Quarterly Result

Quarterly Report For The Financial Period Ended 30 June 2024

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

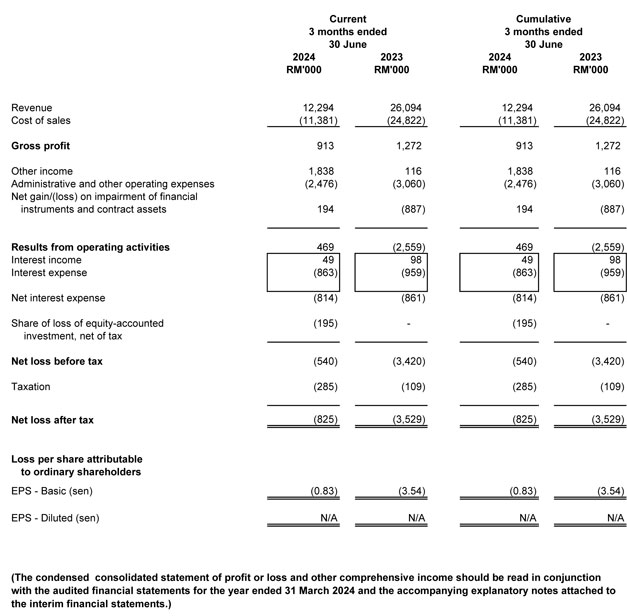

Condensed consolidated statement of profit or loss and other comprehensive income

For the financial period ended 30 June 2024

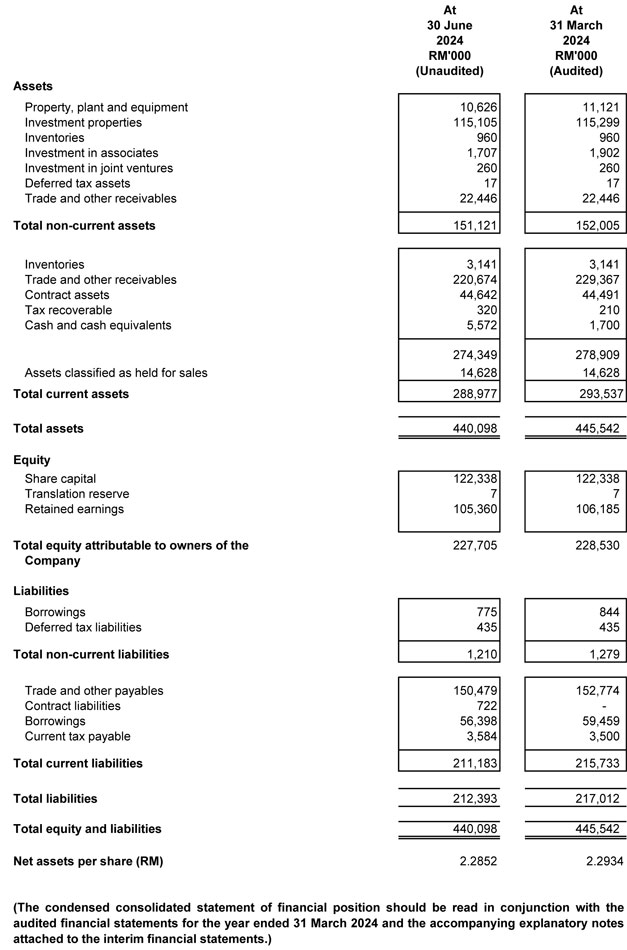

Condensed consolidated statement of financial position

As At 30 June 2024

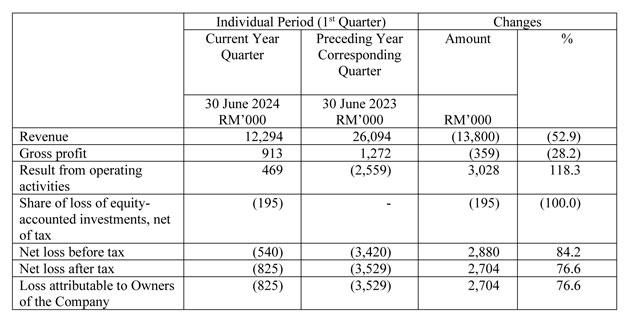

Detailed analysis of the performance of all operating segments of the Group in 1Q 2025

Current quarter ("1Q 2025") against preceding year corresponding quarter ("1Q 2024")

For 1Q 2025, the Group recorded lower revenue of RM12.294 million, a decrease of 52.9% compared to revenue of RM26.094 million in 1Q 2024, mainly due to lower contributions from the trading sector. Despite the decrease in revenue, the Group recorded a lower loss before tax of RM0.540 million in 1Q 2025, compared to a loss before tax RM3.420 million in 1Q 2024, mainly due to a one-off gain of RM1.714 million from the disposal of plant and equipment and lesser overheads incurred in 1Q 2025. Additionally, the 1Q 2024 results included a net impairment loss of RM0.887 million, whereas the 1Q 2025 recorded a net impairment gain of RM0.194 million on its receivables.

The performance of the respective operating business sector for the 1Q 2025 under review as compared to the 1Q 2024 are analysed as follows:

TradingRevenue decreased by RM14.214 million, or 65.0%, to RM7.669 million in 1Q 2025, compared to RM21.883 million in 1Q 2024, mainly due to lesser demand for building materials as certain on-going projects of our customers have reached the tail end stage of their construction work. Despite the significant decrease in revenue, the sector reported a lower loss before tax of RM0.546 million in 1Q 2025, compared to a loss before tax of RM0.872 million in 1Q 2024. This improvement was mainly due to the recognition of a net impairment gain of RM0.194 million on its receivables in 1Q 2025, compared to a net impairment loss of RM0.887 million in 1Q 2024.

Property developmentNo revenue was recorded in 1Q 2025 and 1Q 2024. Accordingly, the sector reported a comparable loss before tax of RM0.104 million in 1Q 2025, compared to RM0.108 million in 1Q 2024.

ConstructionThe construction sector reported revenue of RM4.634 million in 1Q 2025, compared to RM5.446 million in 1Q 2024, mainly due to a lower percentage of work done for its on-going construction projects. Despite the decrease in revenue, the sector recorded a profit before tax of RM0.119 million in 1Q 2025, compared to a loss before tax of RM1.197 million in 1Q 2024, mainly due to a one-off gain of RM0.511 million from the disposal of plant and equipment, as well as lower overheads incurred in 1Q 2025.

Investment propertyThe sector recorded slightly higher revenue of RM0.706 million in 1Q 2025 compared to RM0.683 million in 1Q 2024. The sector reported a profit before tax of RM0.283 million in 1Q 2025, compared to a profit before tax of RM0.145 million in 1Q 2024, mainly due to increase in revenue and lesser overheads incurred in 1Q 2024.

Other servicesThe revenue decreased from RM0.268 million in 1Q 2024 to RM0.218 million in 1Q 2025, mainly due to lower income contributions from landscape maintenance work. Despite the decrease in revenue, the sector reported a profit before tax of RM0.971 million in 1Q 2025, compared to a loss before tax of RM0.279 million in 1Q 2024, mainly due to a one-off gain of RM1.201 million from the disposal of plant and equipment in 1Q 2025.

Current year to date ("YTD 2025") against preceding year corresponding year ("YTD 2024")

As the comparatives are for the 1st quarter results, the analysis of the respective operative business sectors will be the same for 1Q 2025.

Prospects

The Board expects the economic outlook to remain challenging in the near term amid ongoing inflation, rising interest rates, as well as a weakening Ringgit, which is affecting the construction and property industries. The Construction Division anticipates a less favorable outlook and a more competitive tender environment due to high building material costs and limited construction projects in the market. The Group adopts a highly selective approach to tendering, prioritizing projects with sufficient margins to accommodate inflationary pressures, strategically replenishing its order book.

Given the challenging business environment and depleting order books, the Board is of the opinion that the near-term prospects are expected to remain challenging, and we anticipate that the financial performance of the Group for the financial year ending on 31 March 2025, may be adversely impacted.

As at 30 June 2024, the Group's order book for the construction sector stood at RM153 million.

The Board is mindful of the competition and operational risks that could impacts its financial results and will continue to take all proactive measures to ensure the existing business remains sustainable, resilient, and focused on delivering and completing all its projects within the budget and on schedule.