Latest Quarterly Result

Quarterly Report For The Financial Period Ended 31 March 2025

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

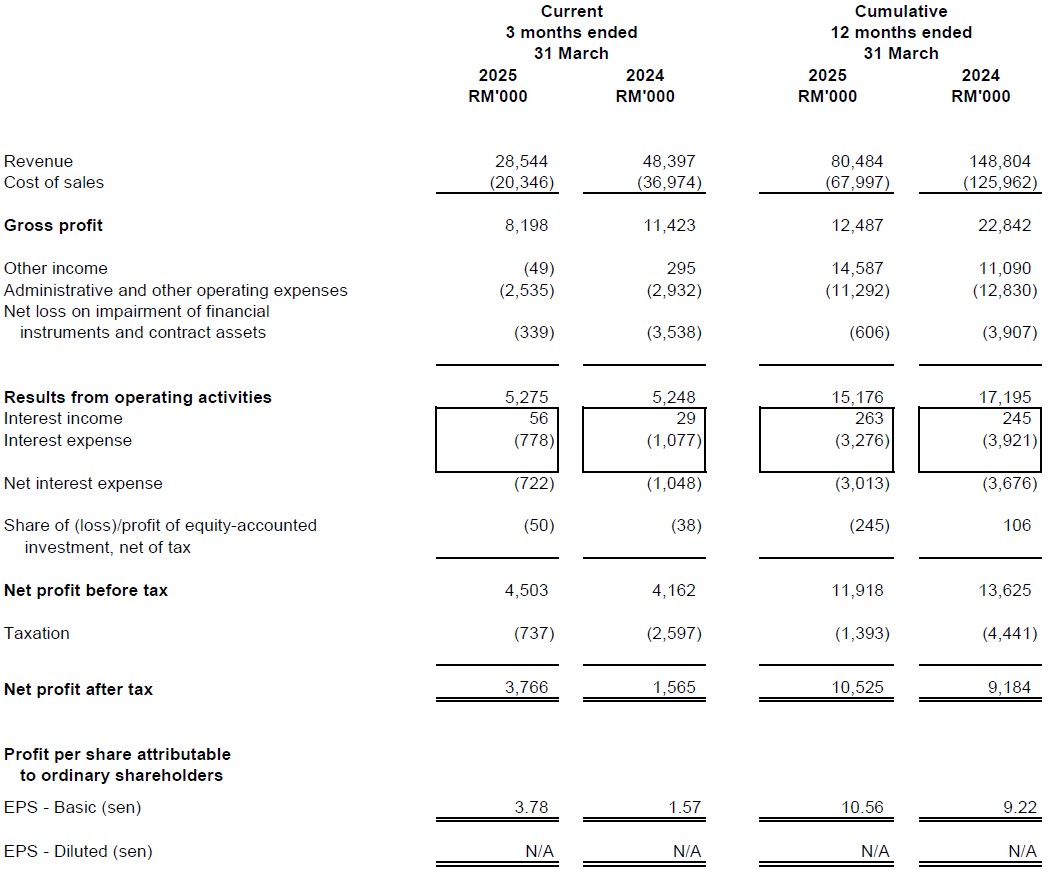

Condensed consolidated statement of profit or loss and other comprehensive income

For the financial period ended 31 March 2025

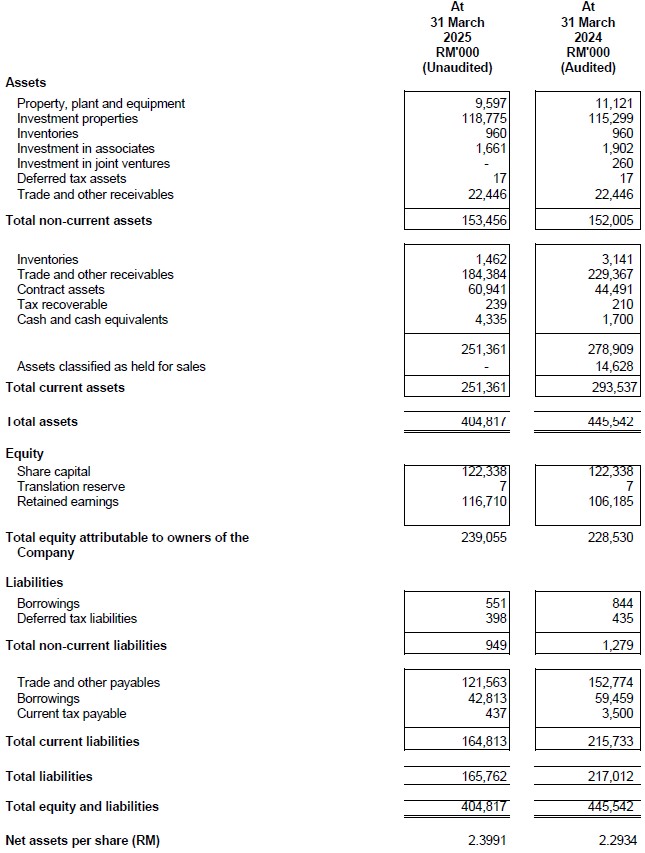

Condensed consolidated statement of financial position

As At 31 March 2025

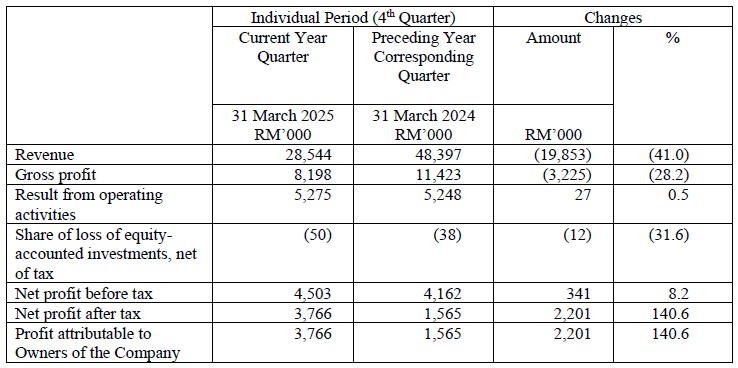

Detailed analysis of the performance of all operating segments of the Group in 4Q 2025

Current quarter ("4Q 2025") against preceding year corresponding quarter ("4Q 2024")

In 4Q 2025, the Group recorded lower revenue of RM28.544 million, a 41.0% decrease from RM48.397 million in 4Q 2024, mainly due to lower contributions from the construction and trading sectors. Despite the decline in revenue, the Group reported a higher profit before tax of RM4.503 million in 4Q 2025, compared to RM4.162 million in 4Q 2024. The improved profit was mainly attributable to the finalisation of certain project accounts with clients and the re-calibration of profit margins for projects nearing completion in 4Q 2025.

The performance of the respective operating business sector for the 4Q 2025 under review as compared to the 4Q 2024 are analysed as follows:

TradingThe sector reported revenue of RM6.900 million in 4Q 2025, a 28.1% decrease from RM9.603 million in 4Q 2024, primarily due to lower demand for building materials following the completion of several major projects by key customers.

The sector recorded a higher loss before tax of RM1.860 million in 4Q 2025, compared to a loss before tax of RM1.147 million in 4Q 2024. The increase in loss was mainly attributable to a higher net impairment loss on receivables amounting to RM1.744 million in 4Q 2025 (4Q 2024:RM0.963 million).

Property developmentNo revenue was recorded in 4Q 2025 and 4Q 2024. However, the sector reported a profit before tax of RM0.040 million in 4Q 2025, compared to a loss before tax of RM0.392 million in 4Q 2024. The improvement was mainly due to the reversal of over-accrued overhead cost in 4Q 2025.

ConstructionThe construction sector reported lower revenue of RM22.586 million in 4Q 2025, compared to RM39.899 million in 4Q 2024, mainly due to a lower percentage of work done for its ongoing projects. Despite the decline in revenue, the sector recorded a higher profit before tax of RM9.930 million in 4Q 2025, compared to RM4.420 million in 4Q 2024. This improvement was mainly due to the finalisation of certain project accounts with clients and the re-calibration of profit margins for projects nearing completion, which contributed to improved financial results. Additionally, the results for 4Q 2025 were positively impacted by a net impairment gain on receivables of RM1.734 million, compared to a net impairment loss of RM5.596 million in 4Q 2024.

Investment propertyThe sector recorded lower revenue of RM0.430 million in 4Q 2025, compared to RM0.690 million in 4Q 2024, mainly due to termination of tenancy for an investment property. The sector reported a higher loss before tax of RM2.022 million in 4Q 2025, compared to a loss before tax of RM0.056 million in 4Q 2024, mainly due to a net impairment loss of RM2.027 million (4Q 2024:Nil) on investment properties recognised during the 4Q 2025.

Other servicesThe sector recorded lower revenue of RM0.174 million in 4Q 2025, compared to RM0.263 million in 4Q 2024, mainly due to lower income contributions from landscape maintenance work. The sector reported a loss before tax of RM0.452 million in 4Q 2025, compared to a profit before tax of RM2.621 million in 4Q 2024, mainly due to a significant lower net impairment gain on receivables of RM0.170 million in 4Q 2025, versus a higher net impairment gain of RM2.716 million in 4Q 2024.

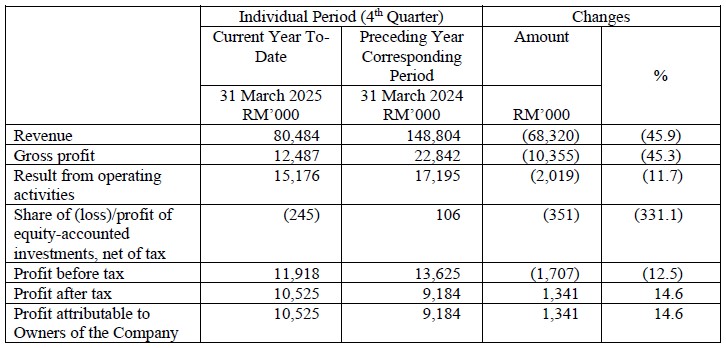

Current year to date ("YTD 2025") against preceding year corresponding year ("YTD 2024")

For the YTD 2025, the Group recorded revenue of RM80.484 million, a decrease of RM68.320 million or 45.9% from RM148.804 million in YTD 2024, mainly due to lower contributions from the trading and construction sectors.

Profit before tax declined to RM11.918 million in YTD 2025, compared to RM13.625 million in YTD 2024, mainly due to lower sales volume. The impact, however, was partially mitigated by a one-off gain of RM12.033 million (YTD 2024:RM9.873 million) from the disposal of an investment property.

The performance of the respective operating business segments for the YTD 2025 under review as compared to the YTD 2024 are analysed as follow:

TradingThe trading sector reported lower revenue of RM32.808 million in YTD 2025, compared to RM61.812 million in YTD 2024, mainly due to reduced demand for building materials following the completion of several major projects by key customers.

The sector recorded a higher loss before tax of RM4.496 million in YTD 2025, compared to a loss before tax of RM1.308 million in the YTD 2024. The increase in loss was mainly attributable to the decline in sales, a higher net impairment loss on receivables amounting to RM2.107 million in YTD 2025 (YTD 2024: RM1.231 million), as well as a provision of RM0.590 million for additional project completion costs that could not be recovered from the client.

Property developmentThe property development sector recorded lower revenue of RM3.540 million in YTD 2025, compared to RM9.826 million in YTD 2024, mainly due to the absence of a one-off disposal of a piece of freehold vacant commercial land, which contributed RM8.08 million in revenue in YTD 2024 and carried a higher profit margin due to its low carrying value. Accordingly, the sector reported a lower profit before tax of RM0.960 million in YTD 2025, compared to RM6.650 million in YTD 2024.

ConstructionThe construction sector registered lower revenue of RM46.825 million in YTD 2025, compared to RM83.213 million in YTD 2024, mainly due to a lower percentage of work done for ongoing projects. Despite the decline in revenue, the sector recorded a higher profit before tax of RM9.440 million in YTD 2025, compared to a profit before tax of RM1.247 million in YTD 2024. The improvement was mainly due to the finalisation of certain project accounts with clients and the re-calibration of profit margins for projects nearing completion. Additionally, the results in YTD 2025 were favourably impacted by a net impairment gain on receivables of RM1.734 million, compared to a net impairment loss of RM5.596 million in YTD 2024.

Investment propertyThe investment property sector reported a decrease in revenue to RM2.329 million in YTD 2025, compared to RM2.713 million in YTD 2024, mainly due to termination of tenancy for an investment property. Despite the lower revenue, the sector recorded a higher profit before tax of RM10.624 million in YTD 2025, up from RM10.083 million in YTD 2024. The improved performance was mainly due to a one-off gain of RM12.033 million from the disposal of an investment property in YTD 2025, (YTD 2024: gain of RM9.873 million), partially offset by a net impairment loss of RM2.027 million (YTD 2024:Nil) on investment properties recognised in YTD 2025.

Other servicesThe revenue for YTD 2025 is comparable to YTD 2024, at RM0.817 million versus RM0.816 million. The sector recorded a loss before tax of RM0.006 million in YTD 2025, compared to a profit before tax of RM1.633 million in YTD 2024, mainly due to a significantly lower net impairment gain on receivables of RM0.164 million (YTD 2024: RM2.616 million). However, the loss was partially mitigated by a higher one-off gain from the disposal of plant and equipment amounting to RM1.220 million (YTD 2024: RM0.442 million).

Prospects

Malaysia's Budget 2025 allocates RM335 billion for operating expenditures and RM86 billion for development expenditures. A significant portion of the development allocation is directed towards transportation infrastructure, including highways, ports, and rail projects. These allocations offer potential opportunity for growth, particularly in public sector-led developments.

However, Malaysia's economic outlook for 2025/2026 is expected to be shaped by developments in global trade, particularly the reciprocal tariffs introduced by the United States. These trade tensions continue to disrupt global supply chains and contribute to broader market volatility and the long-term effects of these tariffs remain unclear.

The Board anticipates that the economic outlook will remain challenging in the near term, amid ongoing inflationary pressures, rising material and labour costs, the potential introduction of a carbon tax, and the rationalisation of government subsidies. These factors are expected to further pressure on the construction and property sectors.

To mitigate these risks, the Group has adopted a highly selective tendering strategy, focusing on projects with sufficient profit margins to cushion the impact of cost escalations and support operational sustainability. The Group remains committed to its core business segments-namely building materials trading, civil construction, and building works, while actively exploring viable opportunities to replenish its order book and maintain business continuity.

Given the abovementioned soft market and economic outlook, the Board anticipates that the financial performance of the construction and trading sectors for the financial year ending on 31 March 2026, may be adversely impacted.